National Philanthropic Trust UK is pleased to publish our ninth annual UK Donor-Advised Fund Report.

A donor-advised fund (DAF) is a philanthropic fund established under an umbrella charity who administers the DAF account on behalf of the donor. A donor makes an irrevocable charitable contribution, receives immediate tax relief and then recommends charitable grants from the DAF account over time. The donor also recommends how the charitable assets are invested before being granted out.

Our 2024 UK Donor-Advised Fund Report examines data from 2019 to 2022 from UK charities that offer donor-advised funds. The findings confirm that donor-advised funds continue to play an important role in UK philanthropy. DAF donors respond quickly and generously in the face of pressing challenges and serve an important role in sustained giving.

In 2023:

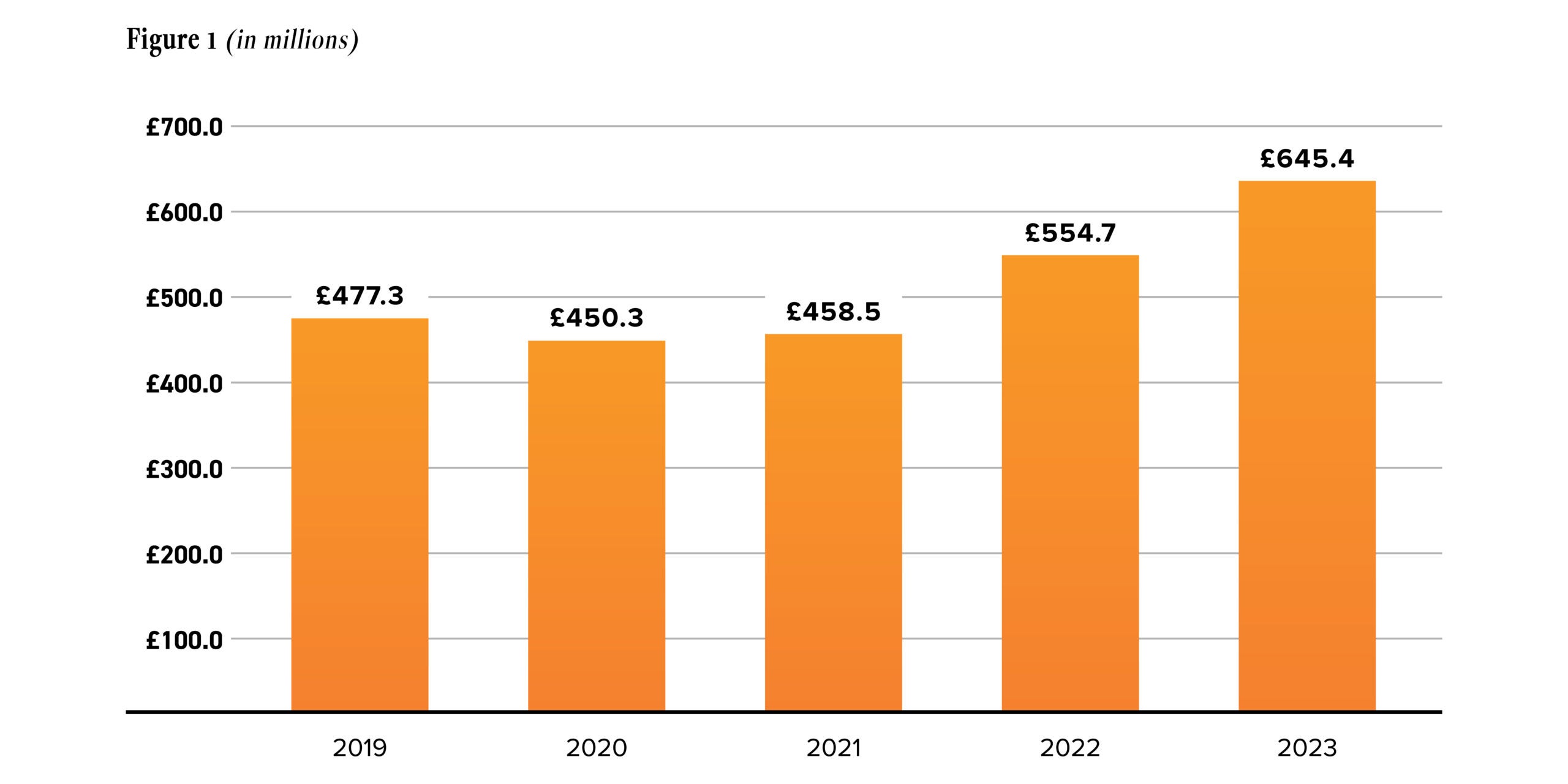

- Grants from donor-advised funds to other charities were £645.4 million, an increase of 16.4 per cent over the prior year.

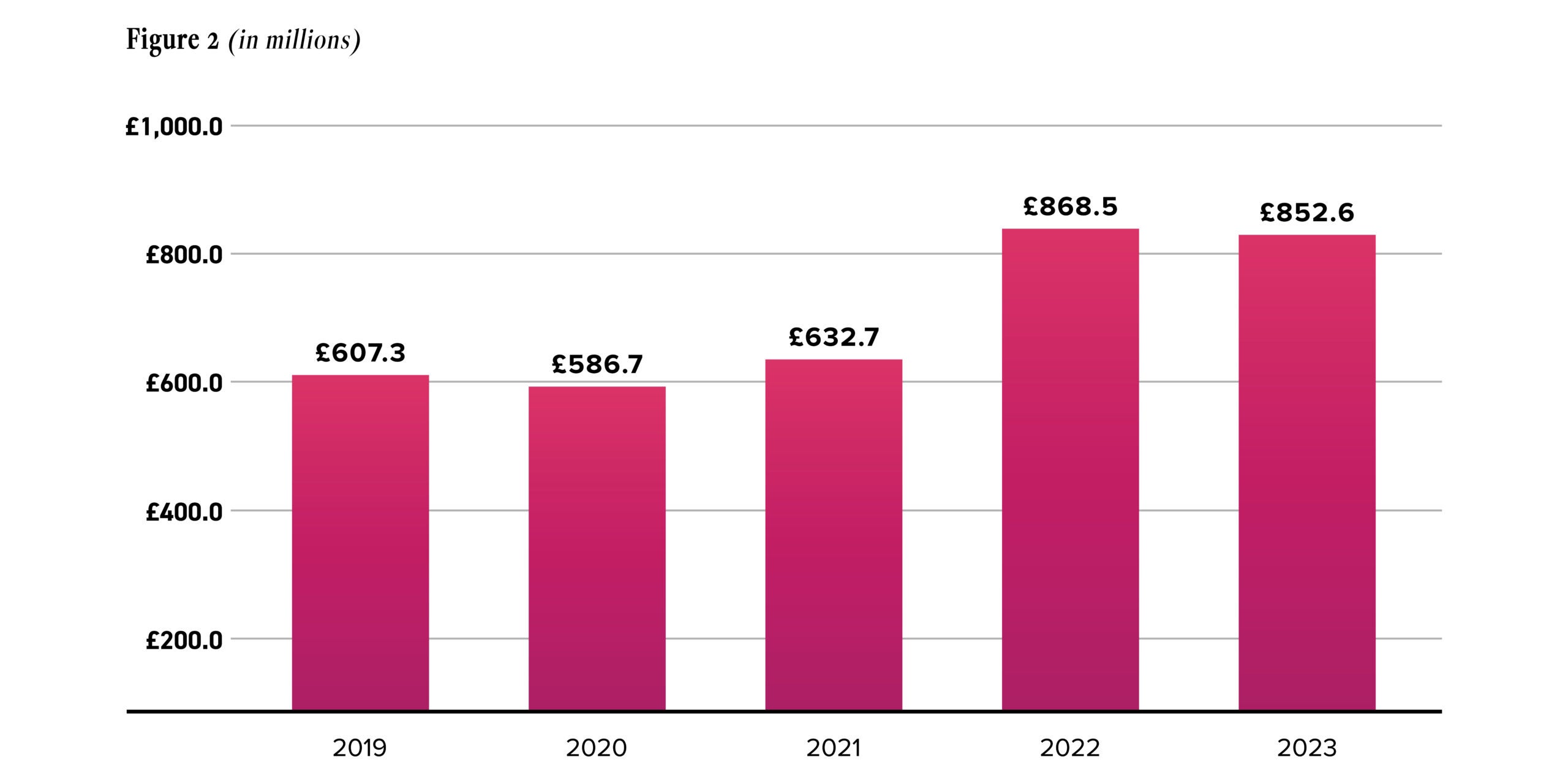

- Contributions to donor-advised funds were £852.6 million, a 1.8 per cent decrease compared with prior year’s contributions.

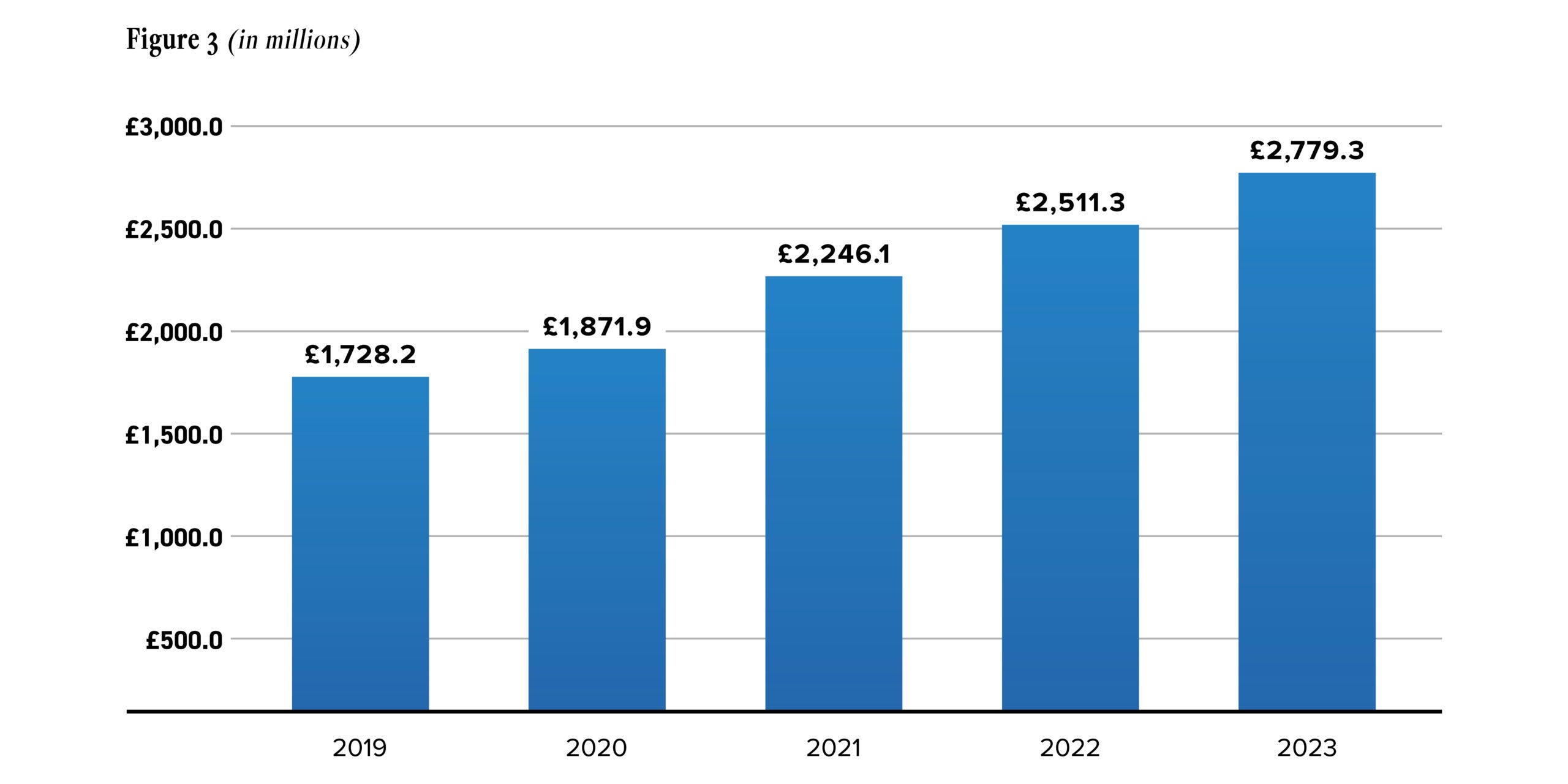

- Charitable assets in donor-advised funds total £2.8 billion — an increase of 10.7 per cent over the prior year.

- The aggregate grant payout rate from donor-advised funds was 25.7 per cent in 2023.

Donors and their advisors increasingly use donor-advised funds as the modern alternative to establishing a grantmaking charitable trust or foundation. Since every pound in donor-advised fund accounts is destined for charitable organisations, the increased use of donor-advised funds is good news for UK charities and charities around the world that receive grants from DAFs.

John Canady

CEO

About This Report

A donor-advised fund (DAF) is a giving vehicle that enables donors to support charitable organisations. DAFs can be used as an alternative to a grantmaking charitable trust or foundation. National Philanthropic Trust UK provides this report as a public service to those who are interested in the impact of this charitable giving vehicle.

A Glossary of Terms

Charitable Assets

The amount charitable sponsors hold and manage in donor-advised fund accounts. Some charitable sponsors manage other types of funds as well. This report is limited to assets in donor-advised fund accounts.

Charitable Organisation

A charity. In the context of this report, a charitable organisation can be either a charitable sponsor of donor-advised funds or the recipient of a donor-advised fund grant. A UK charitable organisation is registered at the Charity Commission and a foreign charitable organisation is eligible to receive grants from the UK according to HMRC and Charity Commission regulations. Donations to a charitable organisation are eligible for tax relief. A charitable organisation serves broad public purposes in educational, religious, scientific, and artistic fields, among others, as well as the relief of poverty and other public benefit activities.

Charitable Sponsor

A charitable organisation that manages donor-advised fund accounts. Charitable sponsors provide services to ensure that potential grant recipients are qualified charitable organisations and administer donor-advised fund accounts to ensure compliance with all regulations. Also called sponsoring charity, fund sponsor or umbrella charity.

Contribution

Amount a donor donates to a donor-advised fund account when establishing the fund or adding money to it.

Donor-Advised Fund

A philanthropic giving vehicle administered by a charitable sponsor. A donor-advised fund allows donors to establish and fund the account by making irrevocable, tax-relieved contributions to the charitable sponsor. Assets in the account are invested based on the donors’ recommendations. Donors then recommend grants from those funds to other qualified charitable organisations.

Grant

A transfer of assets from a donor-advised fund account to a qualified charitable recipient.

Market Overview

In 2023, total estimated charitable giving in the United Kingdom was £13.9 billion, according to the CAF UK Giving Report. Contributions to DAFs totalled £852.6 million in 2023.

In this report, we analyse giving to and from DAFs for fiscal year 2023. Charities operate on different fiscal year periods, which means the reporting period began as early as 1 May 2022 for some charities and ended as late as 31 December 2023 for others.

The past year has been marked by global economic uncertainty and political turmoil around the world. These geopolitical and economic indicators played an important role in where and how donors gave. In the UK, the cost of living crisis continued to put financial pressure on families. Charities also faced increased costs due to inflation, while the demand for their services continued to rise. Against a backdrop of a challenging year, donors have responded with unprecedented compassion and generosity.

In 2023, the UK DAF market continued to grow across the key metrics of grants and AUM. Grants increased in 2023 reflecting donors’ generosity in the face of growing needs. Grants from donor-advised funds help to provide sustained support over the longer term. While contributions decreased slightly in 2023, donors still contributed over £852 million in 2023 for strategic giving over the longer term.

Grants Total £645 Million

Grants from donor-advised funds to charitable organisations totalled £645.4 million, an increase of 16.4 per cent. The compound annual growth rate from 2019 to 2023 was 7.8 per cent.

Contributions Decrease Slightly

Contributions to donor-advised funds in 2023 totalled £852.6 million, a slight decrease of 1.8 per cent. The compound annual growth rate was 8.9 per cent for contributions from 2019 to 2023.

Charitable Assets Reach £2.8 Billion

Charitable assets under management in all donor-advised funds totalled £2.8 billion in 2023, an all-time high. This is a 10.7 per cent growth rate compared to 2022. The compound annual growth rate for charitable assets from 2019 through 2023 was 12.6 per cent. All charitable assets in DAFs must be used for charitable purposes.

Looking Forward

We expect continued growth in donor-advised funds given the convenience that DAFs offer as an alternative to setting up a grantmaking charity, charitable trust or foundation. We also expect growth as donor-advised fund awareness increases amongst the wealth managers, lawyers, and accountants who advise philanthropists.

Based on our own experience and observed trends at our peer charitable organisations, contributions of non-cash assets continue to rise. For example, donors who contribute appreciated shares receive two tax benefits: the gifted shares are not liable for capital gains tax (CGT), and the donor can also claim income tax relief for the market value. We anticipate that donors will increasingly donate non-cash assets to donor-advised funds in the coming years.

We have also seen a rise in the use of donor-advised funds to ensure regulatory compliance. Regulations – particularly around trustee responsibilities and grantmaking due diligence – are constantly evolving. Using a donor-advised fund ensures that a donor is assured of regulatory compliance with the latest regulations.

We expect growth to continue because donor-advised funds are effective giving vehicles for donors to support their favourite charities. DAFs can be used by different generations, across different geographies, and on all time horizons.

Methodology

Organisations

This report examined 11 charities registered at the Charity Commission of England and Wales that sponsor donor-advised funds.

Primary Data Sources

The primary source for each charitable sponsor’s assets, contributions, and grants is the organisation’s Annual Report filed with the Charity Commission of England and Wales.

Secondary Sources

The following served as secondary sources for the above data and cited statistics:

- Filings at Companies House

- The organisations’ websites

- Survey responses from Charitable Sponsors

- CAF UK Giving 2024, Charities Aid Foundation

Projections are based on National Philanthropic Trust UK’s experience and anecdotal evidence over the past year, in addition to observed economic and political conditions.

Standard Fiscal Data by Filing Year

Since organisations have varied financial year-end dates, data was recorded in the filing year. For example, whether an organisation’s fiscal year ends on 31 March 2023 or 31 December 2023, the data will be recorded as 2023.

Payout Calculation

Payout from donor-advised funds is calculated as the current year’s grants divided by charitable assets held at the end of the prior year.

Acknowledgements

This report was prepared by National Philanthropic Trust UK in collaboration with Dr Catherine Walker of The Researchery, an independent research consultancy. Oliver Nicholl-Dovell provided data analysis and research assistance.

National Philanthropic Trust UK gratefully acknowledges all of the organisations that shared their donor-advised fund statistics and information.