How Does Gift Aid Work?

If you are a UK taxpayer, your contribution to an NPT UK donor-advised fund may benefit from Gift Aid.

Under the Gift Aid scheme, the donor and beneficiary charity can reclaim taxes the donor paid to HMRC.

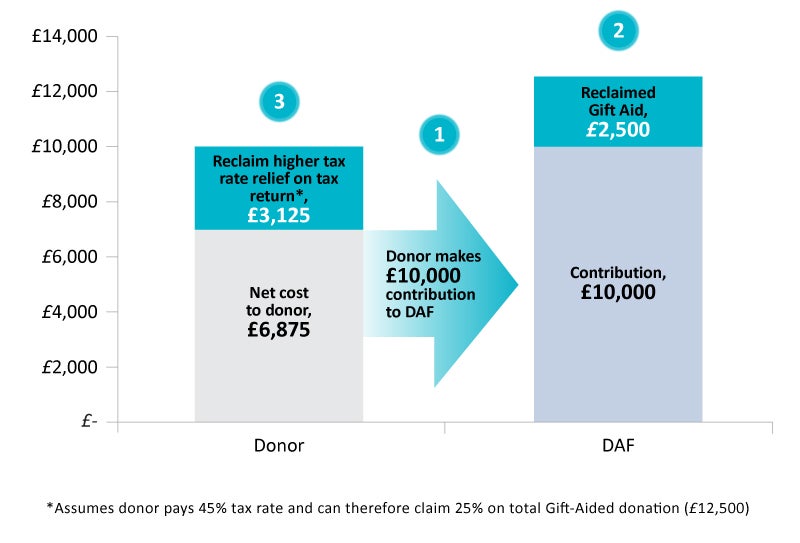

As a registered UK charity, NPT UK is eligible to claim an amount equal to basic rate tax (20%) on the gross gift from HMRC, which equates to 25% of the value of the donation. NPT UK will claim Gift Aid on your contribution and credit your donor-advised fund account for the amount of the reclaimed Gift Aid.

Donors who are higher-rate (40%) or additional rate (45%) taxpayers are eligible to claim the difference between their tax rate and the basic tax rate (20%) on the gross donation. Donors claim this on their self-assessment tax return.

For a donor who is an additional rate taxpayer, a donation of £10,000 provides the DAF with £12,500 for a net cost of £6,875.

To qualify for Gift Aid, donors must make cash contributions. Under the Gift Aid scheme, donors must pay enough UK income and/or capital gains tax in each tax year to cover the amount of tax that charities claim on your behalf for that tax year.

Donors may only claim Gift Aid on new donations to charity. Transfers to an NPT UK DAF from another DAF programme, a charitable foundation or other charitable giving vehicle are not eligible for Gift Aid.

To claim Gift Aid on a contribution to your DAF, you must complete a Gift Aid declaration form.

Please Note: The information provided here is general and educational in nature. It is not intended to be, nor should it be construed as, legal or tax advice. NPT UK does not provide legal or tax advice. NPT UK strongly encourages you to consult with your tax and/or legal advisors before making charitable contributions.